Author: Rafael Marquinez

The pandemic taught us many lessons. One of them, applicable to the business world, including legal services, is the possibility of continuing to work, hold meetings, and even carry out procedures before governmental institutions, all from home. In this sense, it was demonstrated that the physical presence of the actors involved in commercial negotiations and/or governmental procedures, as well as the documentation related to them, in some cases, is not indispensable when it comes to speeding up or even carrying them out.

As a response to the national emergency declared by the Government of the Republic of Panama as a result of the COVID-19 pandemic (the “Pandemic”), the Superintendencia del Mercado de Valores (SMV) adopted measures to mitigate the risk of possible contagion with the purpose of preserving the health and safety of its officers and users, such is the case of Resolution No. SMV-117-20 of 25 December 2005. SMV-117-20 of March 25, 2020, General Resolution of the Board of Directors of the SMV No. JD-3-20 of April 3, 2020, General Resolution of the Board of Directors of the SMV No. JD-12-20 of December 29, 2020, whereby the following measures, among others, were established:

(i) the temporary suspension of attention to the public,

(ii) the availability of an e-mail address to the public: tramites_smv@supervalores.gob.pa through which users could send information and/or documentation (complaints, petitions, consultations, notifications by memorial, and other documents) digitally for their due processing by the SMV, instead of the physical presentation;

(iii) the possibility, in the event of temporary suspension of face-to-face service to the public, of making payments by bank transfer

(iv) the establishment of a special procedure for the notification of administrative acts filed and processed before the SMV, using the e-mail address tramites_smv@supervalores.gob.pa, with the main purpose of guaranteeing the provision of services in the securities market.

(v) that all administrative acts issued by the Board of Directors, the Superintendent or by delegation of the Superintendent, will be notified to the corresponding parties by e-mail, to the address previously indicated by them to hold communications with the SMV and keep them on file. Notifications will be received by the parties from the SMV’s e-mail address: tramites_smv@supervalores.gob.pa and

(vi) the notifications made by e-mail shall be deemed to be made and take effect at the place, time, day, month and year indicated in the e-mail sent, so that the terms to file the administrative appeals provided for in the Single Text of the Securities Market Law shall begin to run as of the business day following the date of sending.

Considering the above, in accordance with the provisions of the SMV’s announcement dated January 13, 2021, the SMV together with the Bolsa Latinoamericana de Valores, S.A. (“Latinex”) formally established a virtual window to optimize the securities registration process before both entities (“Virtual Window”).

This new securities registration process through the Virtual Window began to be effective as of January 2021, both in the primary and secondary markets, including securities registrations made by recurring issuers.

With the arrival of the Pandemic, to the surprise of many, the issuance of securities registered with the SMV and placed through Latinex became very important as a financing method to meet the payment, generally, of existing financial obligations contracted through other mechanisms. Therefore, the establishment of the Virtual Window has been extremely beneficial from the perspective of the registration process, allowing the SMV and Latinex, as well as the users, to achieve these registrations in a faster and more efficient manner, and, at the same time, support the local capital market by facilitating these registrations, which translates into a greater volume of transactions in Latinex.

Requests for securities registrations are made by means of a resolution of the SMV authorizing the registration of securities for public offering, which was previously delivered physically for notification by the legal representative. However, now everything is done at the speed of a click, by e-mail, based on the legal grounds previously described.

This means that with an e-mail received by the user’s legal representative from the SMV, it is understood that he/she has been legally notified, which also represents a significant change through the digitalization of the process.

Through this tool, securities registrations are processed, the process of which required a significant investment of time and a lot of paperwork, since the physical presentation of the same was an indispensable requirement of the securities registration process.

The Virtual Window option for these procedures, in addition to being more environmentally friendly, results in a significant reduction of time and money.

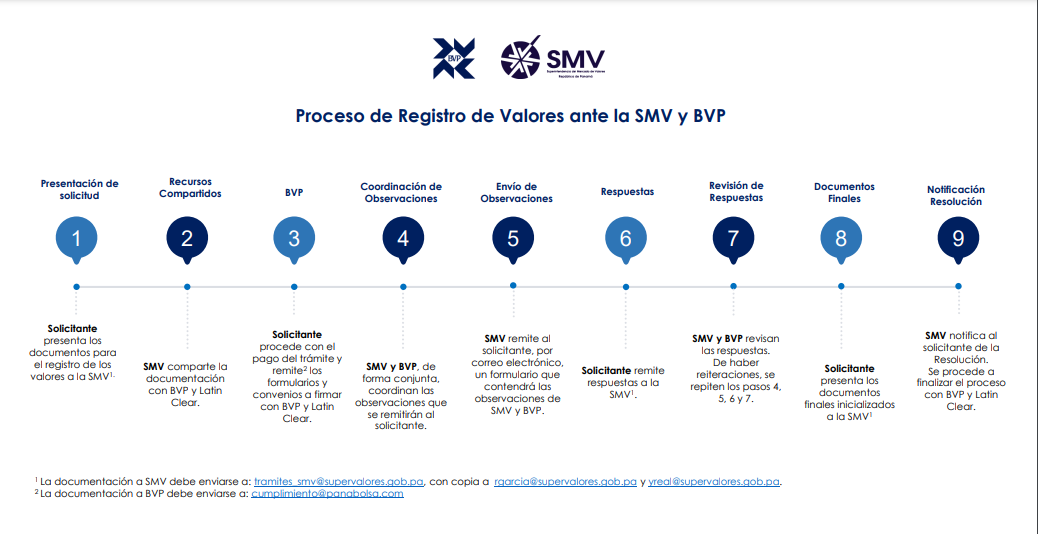

For greater ease and clarity regarding the stages of the securities registration process with the SMV and its listing with Latinex, below you will find the corresponding flow chart, as it has been disclosed by the SMV and Latinex:

Formerly an extensive and physical process

This process used to be physical. A multiplicity of copies were printed, which had to be physically submitted to the SMV, and, on the other hand, the same documentation had to be sent to Latinex. However, the implementation of the Virtual Window for the registration of securities is now a more efficient and orderly process since through the Virtual Window the documentation is submitted in electronic format and it is received by both entities simultaneously, so that the review process by both entities is parallel, and the applicant receives a single note containing the observations of both entities.

It is simple: One submits the documentation by e-mail to the SMV through the e-mail address: tramites_smv@supervalores.gob.pa Once the information is reviewed in parallel by the SMV and Latinex, the user receives a single note consolidating the observations of both entities, which are promptly addressed within the term established by the applicable regulations. The whole process is efficient in terms of an easier, more efficient and expeditious dynamic for the user.

In the past, the process of filing documents could take a day, sometimes two, mainly by having to print and assemble the documentation packages, given the vast amount of dense documents and the number of copies required by the SMV. With the new Virtual Window, it is a matter of minutes as the documentation is sent in electronic format through a digital file.

The benefit has been immediate, as a process that used to take countless hours has now been considerably reduced. On the user’s side, it is much less time-consuming because the user does not have to respond separately to two entities, and the handling of the documentation is completely digital.

Currently, the entire securities registration process before the SMV and Latinex is digital including (i) the filing of the registration application and supporting documentation, (ii) the payment of the corresponding registration and listing fees through ACH or online deposit, (iii) the responses to the observations received from the SMV and Latinex; and (iv) and the receipt and notification of the SMV resolution authorizing the registration of the securities in question.

The direct advantages for the user

The advantage is important: The less time is invested in the registration process, the less costly it is for the user.

Of course, the fees are an important factor but, for the user, this also means that the procedure is expedited in order to settle the securities in question and with the funds received, for instance, it is possible to promptly pay off existing financing, perhaps with less favorable financial conditions than those of the security that is the subject of the public offering in question.

Professional advice

For those in search of a securities registration with the SMV, for its public offering and listing in Latinex, in addition to the presentation of the documents in full and in compliance with the applicable legal formalities, they should try to respond to the observations to such documentation that may arise from the SMV and/or Latinex, as soon as possible, always within the term established by the applicable regulations for such purpose. Ideally, this should be done within a few days, but this often does not happen, depending on multiple factors, for example, among others, if documents from abroad have been requested.

For the securities market, the creation of the Virtual Window has been a game changer. We must ensure that more governmental and regulatory entities facilitate new tools that, like this window, allow procedures that can be carried out completely digitally and shorten the time, translating into significant savings for the benefit of new investments in our country.